Why Engineers Are Betting on Virtual Power Plants

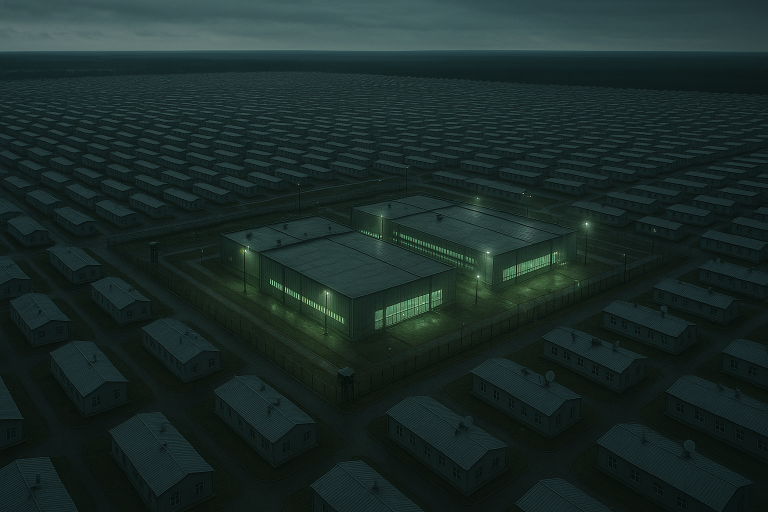

The grid crisis is undeniable: Record heatwaves trigger rolling blackouts, winter storms collapse traditional infrastructure, and surging electricity demand from EVs and data centers strains aging systems. Amid these challenges, a quiet revolution is unfolding in power engineering—one that replaces monolithic power stations with intelligent networks of distributed devices. Virtual Power Plants (VPPs) have emerged as the definitive engineering solution for grid stability in the renewable age, transforming vulnerabilities into resilience through digital orchestration.

The Grid Stability Imperative: From Centralized Weakness to Distributed Resilience

The traditional grid model—a one-way flow from massive centralized plants to passive consumers—is fundamentally unsuited for today’s energy landscape. Engineers now confront a “trilemma”: balancing decarbonization, reliability, and affordability amid escalating demand. In 2023 alone, 28 billion-dollar weather disasters hammered U.S. grids, while data centers and EV adoption surge projected electricity demand by 2.6% annually through 2030 .

Conventional solutions like gas peaker plants are increasingly untenable. They cost 40–60% more to operate than VPP alternatives, emit disproportionately high CO₂, and take years to permit and build . The 2021 Texas grid collapse, which killed hundreds, exposed the catastrophic risks of over-reliance on centralized assets . Engineers now recognize that stability must emerge from distributed coordination rather than monolithic generation—a realization accelerating VPP adoption from California to Germany.

How VPPs Work: Engineering the Digital Grid Brain

At its core, a VPP is a software-defined energy network that aggregates and orchestrates distributed energy resources (DERs) into a unified grid asset. Unlike physical power plants, VPPs have no single location. Instead, they integrate:

- Rooftop solar arrays (generation)

- Home/commercial batteries (storage)

- EV fleets and smart chargers (dynamic load/shifting)

- Smart appliances & HVAC systems (demand response)

Table: VPP Technical Stack Components

| Layer | Function | Key Technologies |

|---|---|---|

| Device Layer | Energy generation/storage/shifting | Solar inverters, battery systems, EVs |

| Control Layer | Real-time device communication | OpenADR, MQTT protocols |

| Intelligence Layer | Optimization & forecasting | AI algorithms, predictive analytics |

| Market Layer | Grid services participation | DERMS (Distributed Energy Resource Mgmt) |

The engineering magic lies in the control architecture. VPPs use predictive algorithms and real-time telemetry to balance grid constraints. When a heatwave spikes demand, the VPP software might:

- Discharge thousands of home batteries simultaneously

- Adjust smart thermostats by 2°F to shed load

- Delay EV charging for participating vehicles

- Feed solar surplus from commercial buildings into the grid

This coordination happens autonomously via cloud-based platforms, transforming fragmented DERs into a dispatchable resource rivaling traditional plants in responsiveness.

Why Engineers Are Choosing VPPs: The Technical Advantage

Scalability without infrastructure inertia: Traditional plants require 5–10 years for permitting and construction. VPPs can scale capacity in months by enrolling more DERs. Tesla’s California VPP grew from 5,000 to 50,000 Powerwall batteries in under two years, delivering 16.5+ MW during beta testing alone . Engineers prize this agility when confronting rapidly evolving grid stresses.

Cost efficiency at scale: VPPs avoid $50–$100 billion in grid infrastructure investments by leveraging existing behind-the-meter assets. MIT studies confirm VPPs deliver grid services at 60% lower cost than gas peakers . For utilities like Vermont’s Green Mountain Power, this translates to 22% lower consumer bills while enhancing reliability .

Grid resilience through decentralization: VPPs eliminate single points of failure. When wildfires threaten transmission lines, localized VPP clusters (e.g., solar + microgrids) can “island” critical facilities. During California’s 2022 heatwave emergency, VPPs provided 250+ MW of emergency capacity, preventing cascading blackouts .

Renewable integration engine: VPPs solve renewables’ intermittency by time-shifting surplus energy. In Australia, where rooftop solar generates over 10 GW, VPPs store midday solar excess in home batteries, dispatching it at night—smoothing the notorious “duck curve” that strains conventional grids .

Global Proof Points: VPPs in Action

- California (Tesola + PG&E): 7,500-home VPP delivering 30 MW of peak capacity, paying participants $2/kWh for shared battery power during emergencies .

- Germany (Next Kraftwerke): Europe’s largest VPP aggregates 13.5 GW across wind, solar, and bioenergy—proving commercial viability at national scale .

- Australia (Tesla/Energy Locals): 50,000+ solar-battery homes forming a dispatchable 250 MW plant, reducing participant bills by 22% .

- Rocky Mountain Power (sonnen): 3,500+ Utah homeowners enrolled in a VPP receiving $1,920 rebates for sharing batteries during peaks .

Table: Quantified Benefits of Operational VPPs

| Project | Scale | Grid Service Provided | Participant Benefit |

|---|---|---|---|

| Tesla California VPP | 5,000+ homes | 16.5 MW emergency capacity | $2/kWh compensation |

| South Australia VPP | 50,000 homes | 250 MW peak shaving | 22% lower electricity bills |

| Green Mountain Power | 4,000+ batteries | Winter peak reduction | Free battery installation |

| sonnen Utah VPP | 3,500+ homes | Summer demand response | $1,920 battery rebate |

Implementation Challenges: The Engineering Roadmap

Despite their promise, VPPs face hurdles requiring coordinated solutions:

Grid Communication Protocols: Legacy grids lack standardized interfaces for DER coordination. Engineers are adopting OpenADR and IEEE 2030.5 to enable device-agnostic communication. DERMS platforms now provide the critical middleware layer for utility-VPP integration .

Cyber-Physical Security: Connecting millions of devices expands attack surfaces. Solutions include edge-based firewalls in batteries/inverters and blockchain-verified commands. As noted in Energy Informatics, “VPPs inherit security best practices from IoT and edge computing ecosystems” .

Market Design Innovation: Traditional energy markets don’t compensate DER flexibility adequately. Pioneers like PJM Interconnection now accept aggregated DER bids for frequency regulation. The FERC Order 2222 mandate is accelerating this shift in U.S. markets .

Consumer Engagement: Successful VPPs combine automation with user control. Green Mountain Power allows manual overrides during VPP dispatch events while rewarding users who stay hands-off. Octopus Energy’s “Intelligent Go” tariff in the UK optimizes EV charging around user-specified readiness times .

The Future Grid: VPPs as the New Operational Philosophy

Industry projections confirm VPPs will dominate grid architecture:

- U.S. Department of Energy: Targeting 80–160 GW of VPP capacity by 2030—enough to offset 20% of peak national demand .

- Rocky Mountain Institute: Forecasts 61.9 GW of U.S. VPP capacity by 2030, including 17.3 GW from managed EV charging .

- Environmental Impact: RMI estimates VPPs could eliminate 59 million metric tons of CO₂ annually by 2050—equivalent to removing 13 million cars from roads .

The engineer’s vision extends beyond hardware. As Matt Rennie articulates, “Electricity networks of 2030 will not use digital; they will be digital” . Future VPPs will integrate predictive AI forecasting renewable output and load patterns, autonomous microgrids that self-balance communities, and transactive energy markets where buildings trade surplus power peer-to-peer.

Virtual power plants represent more than a technical fix—they embody a fundamental reimagining of grid architecture. For engineers confronting climate volatility and escalating demand, VPPs offer an unparalleled trifecta: scalable resilience without new infrastructure, deep decarbonization via renewable optimization, and democratized energy systems that empower consumers as grid partners. As Shell-owned sonnen scales fivefold and Tesla deploys 50,000-battery networks, the infrastructure transition is already underway. The question is no longer if VPPs will stabilize our grids, but how swiftly engineers can orchestrate this distributed revolution. One truth is electrifyingly clear: the future grid isn’t a monolith—it’s a symphony.