New Super Alloy Could Reduce U.S. Dependence on China-Sourced Cobalt

A breakthrough in materials science by researchers at the Pacific Northwest National Laboratory (PNNL) has reignited discussions about reducing American reliance on Chinese-controlled cobalt supplies. The team recently unveiled a nickel-manganese super alloy designed to replace cobalt-dependent materials in high-stakes applications like advanced nuclear reactors and aerospace systems. While the innovation is hailed as a potential game-changer for supply chain resilience, scalability and performance validation remain critical hurdles.

Cobalt’s Geopolitical Quandary: Beyond Super Alloys

Cobalt’s role extends far beyond super alloys. It is a linchpin in lithium-ion batteries, electronics, and defense systems, with global demand projected to triple by 2030 due to the green energy transition. China’s dominance—controlling 75% of refined cobalt via Congolese mines—creates a chokehold for the U.S., which imports 80% of its cobalt. This dependency poses risks akin to Europe’s reliance on Russian gas: geopolitical leverage, price volatility, and ethical concerns over mining practices in the Democratic Republic of Congo (DRC), where child labor and unsafe conditions persist.

PNNL’s pivot to manganese is strategic. Manganese is the fourth-most-used metal globally, with robust U.S. reserves in states like Minnesota and Montana. Unlike cobalt, it is not classified as a “critical mineral” by the U.S. Geological Survey, meaning supply chains are less centralized. However, China still refines 90% of the world’s manganese, underscoring the complexity of decoupling fully from Beijing’s industrial ecosystem.

The Material Science Tightrope

The alloy’s development hinged on computational models that predicted manganese could mimic cobalt’s ability to stabilize nickel-based alloys at high temperatures. Cobalt’s atomic structure enables “solid solution strengthening,” a process that prevents metal deformation under stress. Manganese, while cheaper and more abundant, has historically been prone to brittleness in extreme environments.

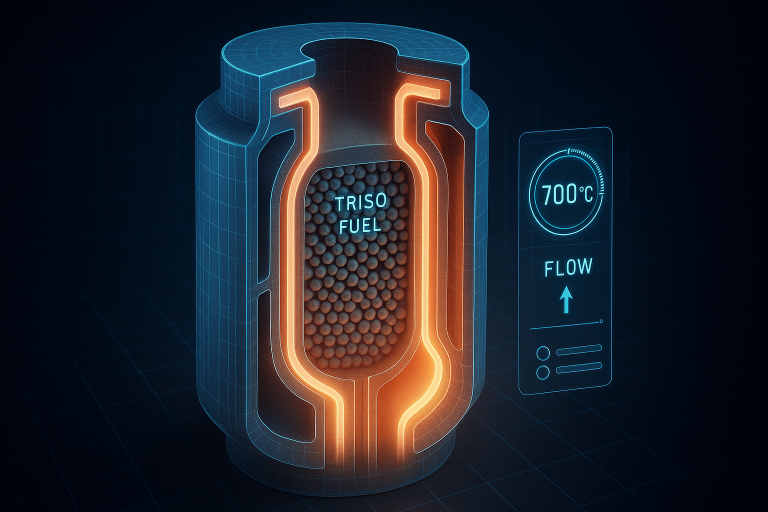

PNNL’s innovation lies in its hybrid manufacturing approach. Traditional casting was paired with friction stir consolidation (FSC), a technique that uses rotational friction to blend materials at the microstructure level. This method enhances grain boundary strength, a common weak point in manganese alloys. Early tests show the material withstands temperatures up to 1,500°F—a promising sign for nuclear reactor components, which operate under similar conditions.

Yet skepticism persists. Some materials scientists caution that cobalt’s creep resistance—its ability to withstand deformation under prolonged stress—is unmatched. Manganese alloys, they warn, may still be prone to cracking under cyclic thermal loads in reactors. Until the alloy undergoes neutron irradiation testing—simulating decades of reactor exposure in months—its viability in nuclear contexts remains unproven.

The Road Ahead: Scaling Challenges and Industry Realities

Transitioning from lab to market requires overcoming three key barriers:

- Performance Validation: The alloy must meet American Society of Mechanical Engineers (ASME) codes for nuclear components—a multi-year process involving rigorous safety tests.

- Manufacturing Retooling: Most U.S. alloy producers are calibrated for cobalt-based systems. Retrofitting facilities for FSC and manganese handling demands significant capital.

- Regulatory Hurdles: Nuclear regulators are inherently risk-averse. Any new material faces intense scrutiny, as seen with the decade-long approval of accident-tolerant fuel claddings.

PNNL is reportedly seeking partnerships with firms in the nuclear and aerospace sectors to accelerate adoption. Success stories, such as the substitution of rare earth magnets with ferrite alternatives in wind turbines, offer a blueprint. However, cobalt’s entrenched role in legacy infrastructure complicates swift transitions. Redesigning critical systems like reactors cannot happen overnight.

A Template for Decoupling?

This research aligns with broader U.S. efforts to rewire critical mineral supply chains. The Inflation Reduction Act (IRA) ties EV tax credits to domestically sourced batteries, while the Defense Production Act prioritizes graphite and rare earth mining. However, fragmented policies risk inefficiency. A 2023 GAO report found that 14 federal agencies oversee critical mineral initiatives, often duplicating efforts.

PNNL’s work exemplifies a “materials-as-diplomacy” approach. By reducing cobalt demand, the U.S. could weaken China’s leverage over the DRC, where Beijing has invested billions in infrastructure-for-minerals deals. Yet this strategy carries unintended consequences: cobalt miners in the DRC, already facing plummeting prices due to oversupply, could suffer economically if demand shrinks further.

Environmental and Economic Trade-offs

Manganese mining, while less ethically fraught than cobalt, poses environmental risks. Land degradation and water contamination from Minnesota’s open-pit manganese mines have drawn criticism from Indigenous communities. Conversely, cobalt recycling remains underdeveloped—a missed opportunity to curb mining demand.

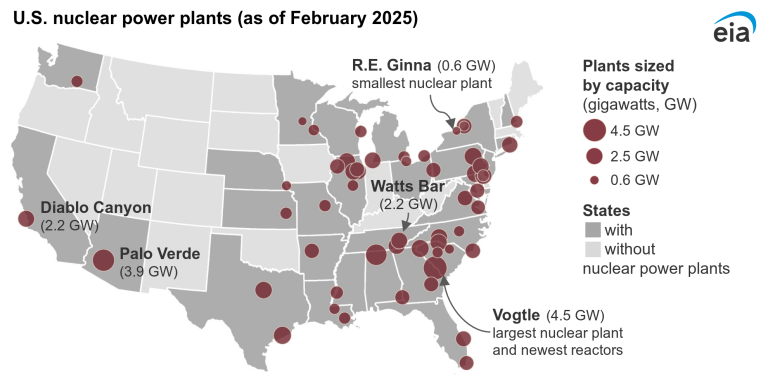

Economically, the alloy could lower costs for advanced nuclear projects, where cobalt-based components account for up to 15% of capital expenses. This aligns with the DOE’s goal to slash nuclear energy costs by 30% by 2035.

A Step Toward Sovereignty

PNNL’s manganese alloy is not a silver bullet, but it signals a paradigm shift in materials science: prioritizing supply chain resilience alongside performance. As the U.S. races to counter China’s mineral dominance, such innovations—paired with stronger recycling programs and international partnerships—could gradually rebalance global power dynamics.

The true test lies in execution. Can policymakers and industry align to fast-track viable alternatives? Or will bureaucratic inertia and market forces perpetuate the status quo? For now, the alloy offers a glimpse of a more self-reliant future—one where national security is forged not just in reactors, but in the microstructures of advanced materials.