Google Bets Big on Starlight: Landmark Fusion Deal with Commonwealth Signals Energy Revolution

Mountain View, CA — In a move that could reshape the future of clean energy, Google has announced a groundbreaking agreement to purchase fusion power from MIT spin-off Commonwealth Fusion Systems (CFS). The landmark deal—the largest fusion power purchase agreement in history—represents both a massive technological gamble and a visionary investment in the elusive dream of harnessing starlight on Earth 16.

The Deal Structure: Power Before Prototype

- Power Purchase: Google secured 200 megawatts (MW) from CFS’s planned ARC (Affordable, Robust, Compact) fusion power plant in Chesterfield County, Virginia—half the facility’s projected 400 MW capacity. This would power approximately 150,000–200,000 U.S. homes 34.

- Strategic Investment: Google increased its stake in CFS (previously an investor in CFS’s $1.8 billion 2021 funding round), with the new investment reportedly “comparable” to the earlier round 15.

- Future Options: Google secured rights to purchase power from additional ARC plants, signaling long-term commitment to fusion scaling 69.

Projected Timeline for CFS Fusion Power

| Milestone | Target Date | Significance |

|---|---|---|

| SPARC Completion | 2026 | Prototype tokamak in Devens, MA |

| SPARC Net Energy | 2027 | First Q>1 (net energy gain) demonstration |

| ARC Operation | Early 2030s | World’s first grid-scale fusion power plant (VA) |

Why Fusion? Why Now?

Google’s audacious bet stems from converging pressures:

- AI’s Insatiable Appetite: Data center energy demand—supercharged by artificial intelligence—is projected to double by 2030. Fusion offers the promise of abundant, 24/7 “baseload” carbon-free power, unlike intermittent solar/wind 57.

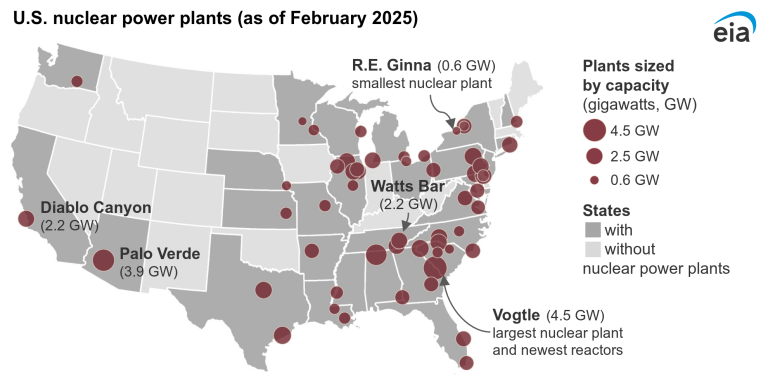

- 24/7 Clean Energy Challenge: Google aims for round-the-clock carbon-free energy by 2030. Current renewables struggle in regions with weak sun/wind or fragmented grids. Fusion could fill critical gaps, especially in the U.S. Southeast and Asia-Pacific 5.

- Strategic Portfolio Diversification: Michael Terrell, Google’s Head of Advanced Energy, describes a three-horizon strategy: near-term (solar/wind), medium-term (geothermal, small modular fission reactors), and long-term (fusion). Fusion represents the ultimate frontier 59.

Commonwealth Fusion’s Pathway to the Stars

CFS leverages decades of MIT plasma physics research and breakthrough magnet technology:

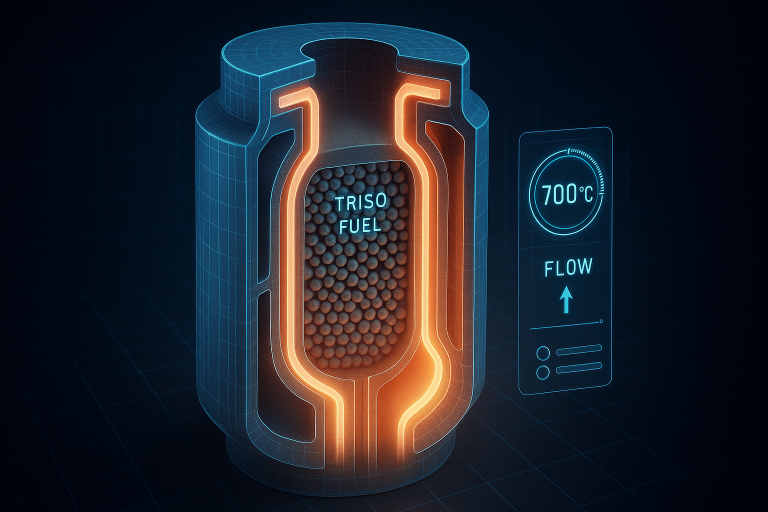

- Tokamak 2.0: CFS uses high-temperature superconducting (HTS) magnets to create stronger magnetic fields in a compact “donut” (tokamak), enabling smaller, cheaper reactors than traditional designs 69.

- SPARC First: The Massachusetts-based SPARC prototype (due 2026) aims to demonstrate net energy gain (Q>1) by 2027—proving fusion can produce more energy than consumed to initiate it 96.

- ARC Commercialization: SPARC’s successor, ARC, will convert fusion heat into electricity. Its Virginia location targets the world’s densest data center corridor, minimizing transmission costs 39.

The Daunting Physics Hurdles

Despite optimism, colossal challenges remain:

- Net Energy Gain: While Lawrence Livermore’s laser-based fusion achieved scientific breakeven in 2022, its 322 MJ input dwarfed its 3.15 MJ output yield. Engineering breakeven—where total plant input exceeds output—remains unproven 17.

- Plasma Taming: Sustaining stable, continuous fusion reactions (not brief pulses) requires unprecedented control over 100 million °C plasma—a feat compared to “containing a star in a magnetic bottle” 17.

- Reliability Unknowns: “Teething problems” like material degradation under neutron bombardment and machine maintenance intervals could delay commercialization 19.

Industry Implications: A Market Signal Heard ‘Round the World

Google’s deal transcends corporate procurement—it’s a catalytic market signal:

- Validating Fusion’s Timeline: By anchoring CFS’s 2030s projection, Google lends credibility to fusion’s commercial viability, potentially unlocking policy/pension fund support 912.

- Tech’s Fusion Arms Race: Microsoft’s 2023 deal with Helion (targeting 2028 fusion) and Google’s parallel investments in TAE Technologies reveal big tech’s fusion arms race 57.

- Accelerating Scale: CFS CEO Bob Mumgaard notes the deal enables parallel development of SPARC and ARC, compressing timelines: “It definitely puts it in a category where now we can work on ARC while finishing SPARC” 35.

The Fusion Promise: Energy’s Holy Grail

If successful, fusion could revolutionize energy economics:

- Fuel Abundance: Deuterium from seawater and lithium-derived tritium offer near-limitless fuel—unlike fission’s uranium constraints 39.

- Zero-Carbon Baseload: Unlike renewables, fusion delivers weather-independent power with no greenhouse gases or long-lived radioactive waste 19.

- Security & Scalability: Modular plants could be built globally, reducing geopolitical energy risks 9.

A Calculated Moonshot

Google acknowledges fusion’s uncertainties—Terrell openly calls it a “moonshot” 7—but argues early investment is critical to bending the cost curve. As Terrell explains: “Technologies like fusion bring the cost down of achieving high penetrations of carbon-free energy… even if they’re more expensive per megawatt-hour, folding them into the portfolio lowers overall costs” 5.

For CFS, Google’s commitment is both capital and validation. As Mumgaard declared: “Fusion power is within our grasp thanks to forward-thinking partners like Google… We aim to enable what will be the largest market transition in history” 69. The stars may still be 93 million miles away, but Chesterfield County, Virginia, just became ground zero in the race to bring their power down to Earth.