Can I Sell Solar Energy to My Neighbors?

As rooftop solar adoption accelerates, many homeowners wonder: Can I sell my excess solar power to neighbors? While traditional net metering lets you send surplus electricity back to the utility grid in exchange for bill credits, a more transformative idea is gaining momentum—peer-to-peer (P2P) energy trading.

Instead of relying on centralized utilities, P2P trading allows neighbors to buy and sell solar power directly. But in 2025, the answer isn’t simple. The regulatory landscape varies dramatically by state, and legal, technical, and financial hurdles remain.

Still, opportunities are growing. From blockchain-enabled platforms to community solar gardens and shared virtual grids, the possibilities for selling solar power—legally and profitably—are evolving. This guide walks you through your options, challenges, and how to get started.

1. Direct Sales Models: Where the Law Stands

a) Peer-to-Peer (P2P) Trading Platforms

Blockchain and smart contracts are reshaping energy markets by enabling secure, automated energy transactions between individuals. Pioneering platforms include:

- Brooklyn Microgrid (NY): A landmark pilot that lets Brooklyn residents sell solar energy to each other via a blockchain-powered app.

- Power Ledger (Australia/US): Expanding in the U.S. in 2025, it supports localized energy trading using real-time pricing and verified solar output.

Legal Status:

- Banned or restricted in most states (40+): Energy sales are often regulated as utility activity, requiring licenses and compliance with state public utility commissions.

- Allowed in pilot zones: A few states like California, New York, Massachusetts, and Hawaii permit P2P energy trading under specific pilot programs supervised by state regulators.

b) Physical Connections Between Homes

Directly wiring your solar system to power a neighbor’s house may sound simple, but it’s almost always illegal under:

- National Electrical Code (NEC): Requires grid-safe standards that are hard to meet in informal setups.

- Utility franchise protections: Utilities typically have exclusive rights to distribute energy in designated territories, making private sales across property lines unlawful.

2. Indirect Legal Workarounds: What’s Possible Today

If direct sales aren’t allowed in your state, consider legal alternatives that let you share solar benefits with others:

a) Virtual Net Metering (VNM) & Community Solar Gardens

Rather than install solar panels on each home, participants invest in a shared solar project—either by buying panels or subscribing to a portion of its output. Each person receives utility bill credits for the energy their share produces.

Benefits:

- No need for on-site panels.

- Great for renters or homes with poor solar exposure.

- Flexible subscription models in many states.

2025 State Snapshot:

| State | Program Status | Max Project Size | Low-Income Access Mandate |

|---|---|---|---|

| New York | Active | 5 MW | 20% of total capacity |

| Illinois | Active | 2 MW | 30% of capacity |

| California | Limited | 20 MW | 25% of capacity |

| Florida | None | N/A | N/A |

Check DSIREUSA.org to see what’s available in your state.

b) Solar Renewable Energy Credits (SRECs)

You may not be able to sell power directly—but you can monetize your system’s environmental impact.

How It Works:

- For every 1,000 kWh (1 MWh) your system generates, you earn 1 SREC.

- Utilities buy these credits to meet state-mandated renewable energy quotas.

Value:

- $5–$300 per SREC, depending on demand in your state.

- Hot markets in 2025: Maryland, Massachusetts, New Jersey.

You can register with SREC aggregators like Sol Systems or SRECTrade to manage the sale of your credits.

3. The Utility Challenge: Why It’s Complicated

a) Monopoly Utility Protections

Utilities, especially investor-owned ones, resist P2P trading for reasons including:

- Revenue loss: They lose money when customers bypass the grid.

- Cost shifting: Non-solar customers may bear more of the cost for grid upkeep.

- Legal control: Many utilities have exclusive distribution rights in their service zones, protected by state law.

b) FERC Order 2222: A Partial Win

The Federal Energy Regulatory Commission (FERC) issued Order 2222, mandating that distributed energy resources (like rooftop solar) be allowed to aggregate and participate in wholesale energy markets.

However, this:

- Does not authorize retail sales to neighbors.

- Requires coordination with local utilities and regional transmission organizations (RTOs).

So, while Order 2222 is a step forward, it doesn’t unlock neighbor-to-neighbor sales yet.

4. Financial & Tax Considerations

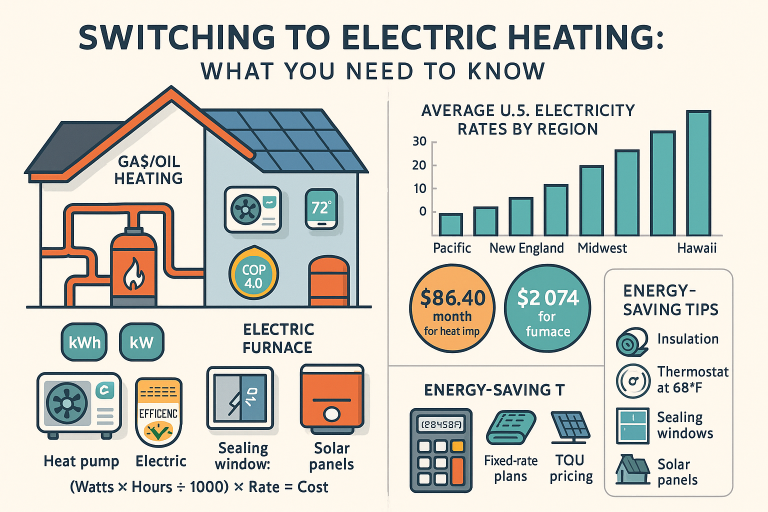

a) Energy Sales Compensation

If you’re in a state that allows P2P or community sales, you should know:

- Avoided-cost rates: These are wholesale prices utilities would pay if they had to generate or buy the power themselves. Often only 3–6¢/kWh.

- Retail rates: What customers pay — usually 12–30¢/kWh.

- Time-of-use (TOU) pricing: Selling during peak hours (e.g., late afternoons/evenings) can increase value if dynamic pricing is allowed.

b) Tax Implications

- Income from energy sales may be taxable. Keep detailed records and consult a tax advisor.

- IRS Form 1099: Platforms or utilities may issue these if your earnings exceed $600.

- The Inflation Reduction Act (IRA): Still offers a 30% federal tax credit for solar installations through 2032, but it does not cover energy income—only installation costs.

5. Homeowners’ Associations, Easements & Local Codes

a) HOA Solar Restrictions

Many states have laws that limit an HOA’s ability to ban solar, but they can still impose reasonable restrictions related to aesthetics, placement, or shared walls.

| State | Can HOAs Ban Solar? | Restrictions Allowed? |

|---|---|---|

| California | No | Yes (if cost increase ≤ $1,000) |

| Arizona | No | Yes (must not impact performance) |

| Florida | No | Yes (may restrict placement to certain roofs) |

| Texas | No | Yes (visual standards, historical rules) |

| Pennsylvania | Yes | N/A |

b) Solar Easements

These are legal agreements you can establish with neighbors to ensure access to sunlight—e.g., preventing new trees or structures from shading your panels.

- Voluntary but enforceable: 30+ states recognize them.

- Tip: Record the easement in local property records to protect resale value.

6. What’s Next: Practical Alternatives & the Future

a) New Models Emerging

- Community Choice Aggregation (CCA): Municipalities pool customer demand and buy clean energy on their behalf. Active in CA, NY, MA, and spreading fast.

- Microgrids & Virtual Power Plants: Neighborhoods combine solar, batteries, and software to operate semi-independently.

- Blockchain Scaling: States like Nevada and Colorado are experimenting with P2P platforms tied to regulatory sandboxes.

b) Action Steps for 2025

- Research your state’s energy policies on DSIRE.

- Join or start a community solar project if P2P sales are not allowed.

- Monetize your solar with SRECs.

- Explore blockchain-based pilot programs in your region.

- Organize a solar buying group with neighbors to reduce costs and build influence.

- Talk to your local legislators about expanding access to P2P trading.

Charting a Path Toward Energy Freedom

In 2025, selling solar energy directly to your neighbors is still more vision than reality in most states—but the tides are shifting. While regulatory barriers persist, alternatives like community solar, virtual net metering, and SREC sales offer accessible, legal ways to benefit from your solar investment.

With the Inflation Reduction Act driving down installation costs and more states adopting solar-friendly laws, the groundwork for energy democratization is here. Keep pushing. The future of energy may well lie in your backyard—and your neighborhood.